Understanding Forex Trading Time Zones for Optimal Trading

In the dynamic world of forex trading, time zones play a crucial role in determining market activity and trading strategies. As the global forex market operates 24 hours a day, it is essential for traders to understand the different trading sessions and how they correspond to various time zones. For effective trading, one must consider forex trading time zones Uganda Brokers and their available resources, which can help in navigating time zone-related challenges.

The Basics of Forex Trading Time Zones

The forex market is divided into several major trading sessions, each corresponding to different financial centers around the world. The primary trading sessions are:

- Asian Session (Tokyo)

- European Session (London)

- North American Session (New York)

Understanding these sessions and their time zones helps traders to identify the best times to enter and exit trades. Moreover, different sessions exhibit different levels of volatility and liquidity, which can significantly affect trading strategies.

Asian Session

The Asian trading session typically runs from 11 PM to 8 AM GMT. This session is characterized by lower volatility compared to the European and North American sessions, but it is crucial for currency pairs that involve the Japanese Yen (JPY) and Australian Dollar (AUD). Traders in this session often focus on news releases reflecting Asian economic developments.

European Session

The European session follows the Asian session and runs from 7 AM to 4 PM GMT. This session is known for its high volatility, especially as traders in London open for business. It represents the largest market share of forex trading due to the sheer number of banks and financial institutions in the region. Pairs like EUR/USD and GBP/USD tend to show significant price movements during this time.

North American Session

The North American session overlaps with the European session and runs from 12 PM to 9 PM GMT. This overlap creates a period of heightened activity, offering traders optimal trading opportunities. The U.S. dollar (USD), being the most widely traded currency, plays a crucial role in this session, particularly affecting major pairs like USD/JPY and USD/CHF.

Time Zone Conversions and Their Importance

As a trader, it is essential to convert trading times to your local time zone. This can be done easily using online tools or mobile applications designed for forex traders. Keeping track of time zones ensures that you do not miss important market movements or trading opportunities. Traders should also be aware of Daylight Saving Time changes that may affect session times.

Strategic Trading Based on Time Zones

To enhance trading strategies, consider the following tips based on time zones:

- Identify Overlapping Sessions: The best trading opportunities often arise during overlapping periods of trading sessions (e.g., when the European and North American sessions overlap).

- Utilize Market News Events: Be aware of scheduled economic releases and news events related to the currencies you are trading. These can significantly impact volatility.

- Adapt Your Trading Style: Different sessions and time zones may require you to adjust your trading style. For example, during the low volatility Asian session, scalping strategies may not be as effective.

- Monitor Key Currency Pairs: Focus on currency pairs that are most active during the session in which you are trading, as this can lead to better execution of trades.

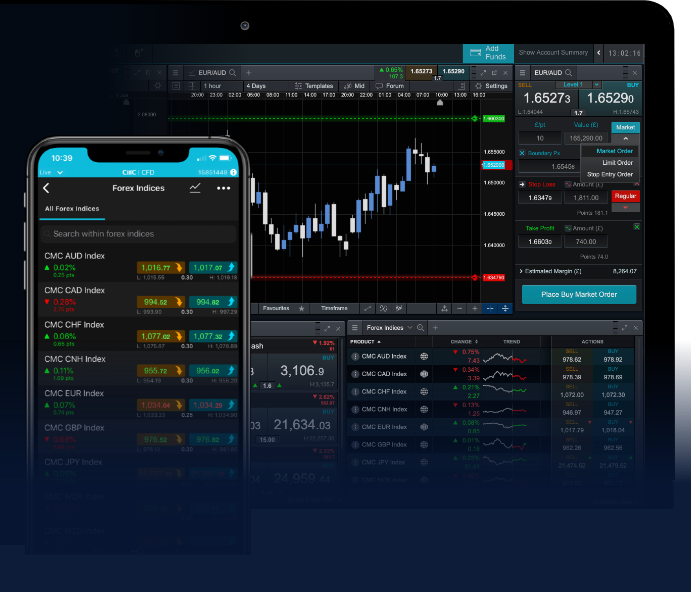

The Role of Technology

In today’s trading environment, technology plays a significant role in helping traders manage time zones effectively. Trading platforms often feature tools that can help streamline time zone conversions and display market hours across different regions. Additionally, mobile trading applications allow traders to manage their trades on the go, adapting to their local time zones without hassle.

Conclusion

Understanding forex trading time zones is essential for any trader aiming for success in the global forex market. By leveraging the knowledge of different trading sessions and their corresponding time zones, traders can optimize their trading strategies, improve execution, and capitalize on price movements effectively. Whether you are a novice or an experienced trader, being aware of these elements can significantly influence your trading outcomes and profitability. As you navigate the forex market, consider the timing and how it aligns with your trading goals.